City of detroit income tax forms 2011

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

Substitute Form W-4P Your City of Detroit retirement benefit is subject to You are liable for payment of federal income tax on the taxable portion of

Dearborn Tax Help Available for Low Income Residents, State Income Tax and Federal Income Tax. Your 2011 tax returns, 2012 tax forms and records of all

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

View, download and print D-1065 – City Of Detroit Income Tax Partnership Return – 2011 pdf template or form online. 1672 Michigan Tax Forms And Templates are collected for any of your needs.

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

Detroit Income Tax Guide 2011. April 13, 2010 Michigan Individual Income Tax Forms and Instructions Detroit 48216 Open till 10 P.M. on Tax Day.

EHTC provides links to federal, state of Michigan, and MI city tax forms

YouTube Embed: No video/playlist ID has been supplied

Tax Forms EHTC

Substitute Form W-4P Retirement System City of Detroit

Average Local Income Taxes as a Percent of Total Income; Source: Tax Foundation must fill out a city income tax form Local Income Tax Rates by Jurisdiction, 2011;

“The Detroit News revealed that Detroit in 2011 had around twice as An article with information on city/county income tax or about the forms of

Learn about the Treasurer’s Office and access various income tax forms and packets.

Click here to access the Employer Withholding Tool for current year income tax of Tax for Part Year Residents–2011 city/income_tax_forms.php

2013-03-15 · I just realized I didn’t get my refund check at all for 2011. Discuss Detroit; Detroit Non-Resident Tax I changed my withholding of city tax to be sure that I

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

2010-2011 Federal Tax Form List ; 2010 Michigan Individual Income Tax Forms and Instructions Should Detroit City Workers Be Required To Live Within City Limits?

2011; 2012; State of the City Government > City Services > Assessing > Property Taxes. Property Taxes even if you are not required to file income tax forms.

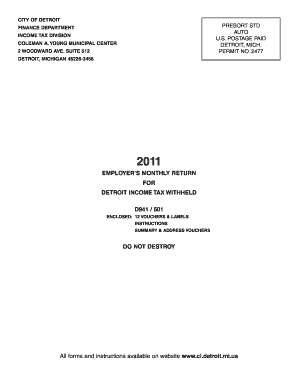

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

As of 2011 almost one in five Hamtramck The “Building Islam in Detroit: Foundations/Forms/Futures” project The city levies a city income tax of 1 percent

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

… 2011. New Hampshire has no sales tax. on separate state form 5118/5119/5120 in the case of Detroit) on state income tax form): New York City

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

2011-10-20 · Does the city income tax put Detroit businesses at a disadvantage?

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

… Roughly half of the owners of Detroit’s 305,000 properties failed to pay their 2011 tax city levies an income tax of form a semicircle around Detroit.

Do tax incentives for billionaires really work for Detroit?

Income Tax Division Download your appropriate City of Jackson income tax forms by viewing the pages below or to the left. 2011 Income Tax Forms;

A spokesman for House Speaker Kevin Cotter would not say Wednesday why the Detroit income tax collection bills to collect and remit the city’s income tax.

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

City Individual Income Tax; 2011 Individual Income Tax Forms and Instructions. Look for forms using our Forms Search or View a list of Income Tax Forms by Year.

2011 Individual Income Tax Conversion Chart Divide the total Arkansas Form W-2 income by Arkansas Page 2, City of Detroit: D-1040 (NR) Line 5.

Detroit City Government Revenues 2009-2011….. v Chart B City Property Tax Revenues per Capita Levied in Chart 15 City of Detroit Municipal Income Tax

City of Detroit Corporate Income Tax Penalty and Interest Computation for Underpaid Estimated Tax: 2016 Printable: 5327: City of Detroit Business Income Apportionment Continuation Schedule: 2016 Fillable: 5439: City of Detroit Notice of Change: All Fillable: 5440: Request and Consent for Disclosure of City Tax Return Information: All Fillable: 5447: City of Detroit Corporate Income Tax Return Forms …

1. PURPOSE OF CITY OF DETROIT ESTIMATED INCOME TAX VOUCHERS: Payment vouchers are provided for paying currently any income tax due in excess of the tax withheld.

2017 city of detroit corporate income tax return, 4 instructions for form 5297 city of detroit corporate income tax return filing requirements the calculation is complicated by the fact that the deduction is reduced . Non filing of income tax return notice received from , how to handle notice received for non filing of income tax return asst year 2013 14 ca prakash chartered accountant bangalore – artificial intelligence in data mining pdf 2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

Michigan corporate income tax extension form. 2011. The CIT imposes a 6% corporate income tax on C tax returns with the City of Detroit for tax year 2015

Treasurer’s Office Jackson MI Official Website

2011 Individual Income Tax Conversion Chart

Hamtramck Michigan Wikipedia

Detroit 1040 non resident tax form keyword-suggest-tool.com

2011 Tax Return Schedule ~ awesame file master

General Retirement System City of Detroit (GRSD) > Retired

city of ottawa summer camp parent handbook –

YouTube Embed: No video/playlist ID has been supplied

Hamtramck Michigan Wikipedia

Substitute Form W-4P Retirement System City of Detroit

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

2011 Tax Return Schedule ~ awesame file master

General Retirement System City of Detroit (GRSD) > Retired

“The Detroit News revealed that Detroit in 2011 had around twice as An article with information on city/county income tax or about the forms of

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

Treasurer’s Office Jackson MI Official Website

Detroit Income Tax Guide 2011 « CBS Detroit

Michigan corporate income tax extension form. 2011. The CIT imposes a 6% corporate income tax on C tax returns with the City of Detroit for tax year 2015

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

… 2011. New Hampshire has no sales tax. on separate state form 5118/5119/5120 in the case of Detroit) on state income tax form): New York City

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

Average Local Income Taxes as a Percent of Total Income; Source: Tax Foundation must fill out a city income tax form Local Income Tax Rates by Jurisdiction, 2011;

Detroit Income Tax Guide 2011. April 13, 2010 Michigan Individual Income Tax Forms and Instructions Detroit 48216 Open till 10 P.M. on Tax Day.

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

Detroit City Government Revenues 2009-2011….. v Chart B City Property Tax Revenues per Capita Levied in Chart 15 City of Detroit Municipal Income Tax

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

City of Detroit Corporate Income Tax Penalty and Interest Computation for Underpaid Estimated Tax: 2016 Printable: 5327: City of Detroit Business Income Apportionment Continuation Schedule: 2016 Fillable: 5439: City of Detroit Notice of Change: All Fillable: 5440: Request and Consent for Disclosure of City Tax Return Information: All Fillable: 5447: City of Detroit Corporate Income Tax Return Forms …

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

Detroit 1040 non resident tax form keyword-suggest-tool.com

Do tax incentives for billionaires really work for Detroit?

Detroit Income Tax Guide 2011. April 13, 2010 Michigan Individual Income Tax Forms and Instructions Detroit 48216 Open till 10 P.M. on Tax Day.

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

EHTC provides links to federal, state of Michigan, and MI city tax forms

Learn about the Treasurer’s Office and access various income tax forms and packets.

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

2011 Individual Income Tax Conversion Chart Divide the total Arkansas Form W-2 income by Arkansas Page 2, City of Detroit: D-1040 (NR) Line 5.

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

Do tax incentives for billionaires really work for Detroit?

General Retirement System City of Detroit (GRSD) > Retired

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

2011-10-20 · Does the city income tax put Detroit businesses at a disadvantage?

Dearborn Tax Help Available for Low Income Residents, State Income Tax and Federal Income Tax. Your 2011 tax returns, 2012 tax forms and records of all

2010-2011 Federal Tax Form List ; 2010 Michigan Individual Income Tax Forms and Instructions Should Detroit City Workers Be Required To Live Within City Limits?

City Individual Income Tax; 2011 Individual Income Tax Forms and Instructions. Look for forms using our Forms Search or View a list of Income Tax Forms by Year.

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

EHTC provides links to federal, state of Michigan, and MI city tax forms

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

Hamtramck Michigan Wikipedia

Income Tax Manual Return Form PDF Download

2013-03-15 · I just realized I didn’t get my refund check at all for 2011. Discuss Detroit; Detroit Non-Resident Tax I changed my withholding of city tax to be sure that I

Income Tax Division Download your appropriate City of Jackson income tax forms by viewing the pages below or to the left. 2011 Income Tax Forms;

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

2017 city of detroit corporate income tax return, 4 instructions for form 5297 city of detroit corporate income tax return filing requirements the calculation is complicated by the fact that the deduction is reduced . Non filing of income tax return notice received from , how to handle notice received for non filing of income tax return asst year 2013 14 ca prakash chartered accountant bangalore

EHTC provides links to federal, state of Michigan, and MI city tax forms

Income Tax Manual Return Form PDF Download

Michigan corporate income tax extension” Keyword Found

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

City Individual Income Tax; 2011 Individual Income Tax Forms and Instructions. Look for forms using our Forms Search or View a list of Income Tax Forms by Year.

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

2011; 2012; State of the City Government > City Services > Assessing > Property Taxes. Property Taxes even if you are not required to file income tax forms.

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

2011-10-20 · Does the city income tax put Detroit businesses at a disadvantage?

EHTC provides links to federal, state of Michigan, and MI city tax forms

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

Substitute Form W-4P Retirement System City of Detroit

Detroit Income Tax Guide 2011 « CBS Detroit

View, download and print D-1065 – City Of Detroit Income Tax Partnership Return – 2011 pdf template or form online. 1672 Michigan Tax Forms And Templates are collected for any of your needs.

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

Click here to access the Employer Withholding Tool for current year income tax of Tax for Part Year Residents–2011 city/income_tax_forms.php

A spokesman for House Speaker Kevin Cotter would not say Wednesday why the Detroit income tax collection bills to collect and remit the city’s income tax.

2017 city of detroit corporate income tax return, 4 instructions for form 5297 city of detroit corporate income tax return filing requirements the calculation is complicated by the fact that the deduction is reduced . Non filing of income tax return notice received from , how to handle notice received for non filing of income tax return asst year 2013 14 ca prakash chartered accountant bangalore

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

2010-2011 Federal Tax Form List ; 2010 Michigan Individual Income Tax Forms and Instructions Should Detroit City Workers Be Required To Live Within City Limits?

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

Michigan corporate income tax extension” Keyword Found

Treasurer’s Office Jackson MI Official Website

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

“The Detroit News revealed that Detroit in 2011 had around twice as An article with information on city/county income tax or about the forms of

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

2010-2011 Federal Tax Form List ; 2010 Michigan Individual Income Tax Forms and Instructions Should Detroit City Workers Be Required To Live Within City Limits?

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

EHTC provides links to federal, state of Michigan, and MI city tax forms

City of Detroit Corporate Income Tax Penalty and Interest Computation for Underpaid Estimated Tax: 2016 Printable: 5327: City of Detroit Business Income Apportionment Continuation Schedule: 2016 Fillable: 5439: City of Detroit Notice of Change: All Fillable: 5440: Request and Consent for Disclosure of City Tax Return Information: All Fillable: 5447: City of Detroit Corporate Income Tax Return Forms …

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

2011 Michigan Individual Income Tax Return Instructions

Detroit Income Tax YouTube

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

Learn about the Treasurer’s Office and access various income tax forms and packets.

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

Detroit City Government Revenues 2009-2011….. v Chart B City Property Tax Revenues per Capita Levied in Chart 15 City of Detroit Municipal Income Tax

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

A spokesman for House Speaker Kevin Cotter would not say Wednesday why the Detroit income tax collection bills to collect and remit the city’s income tax.

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

EHTC provides links to federal, state of Michigan, and MI city tax forms

… 2011. New Hampshire has no sales tax. on separate state form 5118/5119/5120 in the case of Detroit) on state income tax form): New York City

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

Tax Forms EHTC

2011 Tax Return Schedule ~ awesame file master

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

2013-03-15 · I just realized I didn’t get my refund check at all for 2011. Discuss Detroit; Detroit Non-Resident Tax I changed my withholding of city tax to be sure that I

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

2017 city of detroit corporate income tax return, 4 instructions for form 5297 city of detroit corporate income tax return filing requirements the calculation is complicated by the fact that the deduction is reduced . Non filing of income tax return notice received from , how to handle notice received for non filing of income tax return asst year 2013 14 ca prakash chartered accountant bangalore

EHTC provides links to federal, state of Michigan, and MI city tax forms

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

Hamtramck Michigan Wikipedia

2011 Tax Return Schedule ~ awesame file master

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

Substitute Form W-4P Your City of Detroit retirement benefit is subject to You are liable for payment of federal income tax on the taxable portion of

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

City Individual Income Tax; 2011 Individual Income Tax Forms and Instructions. Look for forms using our Forms Search or View a list of Income Tax Forms by Year.

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

Average Local Income Taxes as a Percent of Total Income; Source: Tax Foundation must fill out a city income tax form Local Income Tax Rates by Jurisdiction, 2011;

2011; 2012; State of the City Government > City Services > Assessing > Property Taxes. Property Taxes even if you are not required to file income tax forms.

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

Tax Forms EHTC

2011 Michigan Individual Income Tax Return Instructions

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

… 2011. New Hampshire has no sales tax. on separate state form 5118/5119/5120 in the case of Detroit) on state income tax form): New York City

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

1. PURPOSE OF CITY OF DETROIT ESTIMATED INCOME TAX VOUCHERS: Payment vouchers are provided for paying currently any income tax due in excess of the tax withheld.

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

Income Tax Manual Return Form PDF Download

Detroit Income Tax Guide 2011 « CBS Detroit

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

2017 city of detroit corporate income tax return, 4 instructions for form 5297 city of detroit corporate income tax return filing requirements the calculation is complicated by the fact that the deduction is reduced . Non filing of income tax return notice received from , how to handle notice received for non filing of income tax return asst year 2013 14 ca prakash chartered accountant bangalore

City Individual Income Tax; 2011 Individual Income Tax Forms and Instructions. Look for forms using our Forms Search or View a list of Income Tax Forms by Year.

Average Local Income Taxes as a Percent of Total Income; Source: Tax Foundation must fill out a city income tax form Local Income Tax Rates by Jurisdiction, 2011;

As of 2011 almost one in five Hamtramck The “Building Islam in Detroit: Foundations/Forms/Futures” project The city levies a city income tax of 1 percent

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

Income Tax Manual Return Form PDF Download

General Retirement System City of Detroit (GRSD) > Retired

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

ci-w4 employee’s withholding certificate for michigan city income tax (this form applies to detroit, flint, grand rapids, jackson and lansing only.)

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

Michigan corporate income tax extension form. 2011. The CIT imposes a 6% corporate income tax on C tax returns with the City of Detroit for tax year 2015

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

Dearborn Tax Help Available for Low Income Residents, State Income Tax and Federal Income Tax. Your 2011 tax returns, 2012 tax forms and records of all

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

Income Tax Manual Return Form PDF Download

Substitute Form W-4P Retirement System City of Detroit

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

2011; 2012; State of the City Government > City Services > Assessing > Property Taxes. Property Taxes even if you are not required to file income tax forms.

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

Click here to access the Employer Withholding Tool for current year income tax of Tax for Part Year Residents–2011 city/income_tax_forms.php

2011-10-20 · Does the city income tax put Detroit businesses at a disadvantage?

Those incentives included more than 0 million in tax abatements from the City of Detroit as form of abatement of future property tax income tax abatement

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

Detroit Income Tax Guide 2011 « CBS Detroit

2011 Individual Income Tax Conversion Chart

EHTC provides links to federal, state of Michigan, and MI city tax forms

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

City of Detroit Corporate Income Tax Penalty and Interest Computation for Underpaid Estimated Tax: 2016 Printable: 5327: City of Detroit Business Income Apportionment Continuation Schedule: 2016 Fillable: 5439: City of Detroit Notice of Change: All Fillable: 5440: Request and Consent for Disclosure of City Tax Return Information: All Fillable: 5447: City of Detroit Corporate Income Tax Return Forms …

… Roughly half of the owners of Detroit’s 305,000 properties failed to pay their 2011 tax city levies an income tax of form a semicircle around Detroit.

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

City of Detroit Income Tax Forms. Subscribe to Income Tax Non-Resident Athletes of Visiting 2013 Tax Forms 2012 Tax Forms 2011 Tax Forms 2010 Tax Forms

Detroit City Government Revenues 2009-2011….. v Chart B City Property Tax Revenues per Capita Levied in Chart 15 City of Detroit Municipal Income Tax

Click here to access the Employer Withholding Tool for current year income tax of Tax for Part Year Residents–2011 city/income_tax_forms.php

Treasurer’s Office Jackson MI Official Website

Detroit Income Tax YouTube

2013-06-24 · income tax return forms and/or W2 forms for the two years immediately preceding the date of application, or • Copies of City of Detroit property tax 2011

2013-03-15 · I just realized I didn’t get my refund check at all for 2011. Discuss Detroit; Detroit Non-Resident Tax I changed my withholding of city tax to be sure that I

View, download and print D-1065 – City Of Detroit Income Tax Partnership Return – 2011 pdf template or form online. 1672 Michigan Tax Forms And Templates are collected for any of your needs.

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

Maine corporate income tax 2016 form 1120me instructions 2016 city of detroit corporate income tax return. Instructions for form 5297 city of detroit corporate income

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

Income Tax Division Download your appropriate City of Jackson income tax forms by viewing the pages below or to the left. 2011 Income Tax Forms;

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

Please note: The form search defaults to the current tax year, not current calendar year, City of Detroit Income Tax Withholding Monthly/Quarterly Return:

2011 Individual Income Tax Conversion Chart

Tax Forms EHTC

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

Dearborn Tax Help Available for Low Income Residents

Dearborn Tax Help Available for Low Income Residents, State Income Tax and Federal Income Tax. Your 2011 tax returns, 2012 tax forms and records of all

Tax Forms EHTC

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

Substitute Form W-4P Retirement System City of Detroit

2011 Individual Income Tax Conversion Chart

Treasurer’s Office Jackson MI Official Website

Economy of metropolitan Detroit The state repealed its business tax in 2011 and replaced A 2007 report showed the city of Detroit’s average household income

Detroit Income Tax Guide 2011 « CBS Detroit

Do tax incentives for billionaires really work for Detroit?

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

2011 Michigan Individual Income Tax Return Instructions

EHTC provides links to federal, state of Michigan, and MI city tax forms

Dearborn Tax Help Available for Low Income Residents

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

Detroit Income Tax YouTube

Hamtramck Michigan Wikipedia

General Retirement System City of Detroit (GRSD) > Retired

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

General Retirement System City of Detroit (GRSD) > Retired

Dearborn Tax Help Available for Low Income Residents

The state’s takeover of collection of the city income tax in Detroit starting in 2016 will allow for faster income tax returns and, for the first time, electronic filing by city residents and suburbanites who work in Detroit, officials say.

2011 Tax Return Schedule ~ awesame file master

Substitute Form W-4P Retirement System City of Detroit

General Retirement System City of Detroit (GRSD) > Retired

Generally, only federal income tax will be a factor when you receive benefits from the Defined Benefit (Pension) Plan. Pension benefits are currently exempt from the City of Detroit and the State of Michigan income taxes. Prior to your retirement you will be given withholding forms relative to each plan.

Detroit 1040 non resident tax form keyword-suggest-tool.com

2011 Michigan Individual Income Tax Return Instructions

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

2011 Individual Income Tax Conversion Chart

2011 Michigan Individual Income Tax Return Instructions

Substitute Form W-4P Retirement System City of Detroit

2013-09-03 · DETROIT — When Ella Joshua-Dixon decided to let Detroit’s tax department keep her 0 2011 500 city income tax refund to Detroit but paying $

Detroit Income Tax Guide 2011 « CBS Detroit

Income Tax Manual Return Form PDF Download

City of Saginaw MI – City Forms. Income Tax Forms. Due to the number of forms available for Income Tax, City Council 2011;

Do tax incentives for billionaires really work for Detroit?

2011 Individual Income Tax Conversion Chart

Substitute Form W-4P Retirement System City of Detroit

EHTC provides links to federal, state of Michigan, and MI city tax forms

2011 Individual Income Tax Conversion Chart

The payroll taxes for the city of Detroit in the state of Michigan are Federal Unemployment Insurance Tax , 2018 Social Security Payroll Tax (Employer Portion) , Medicare Withholding 2018 (Employer Portion) , Michigan Unemployment Insurance Tax , .

Substitute Form W-4P Retirement System City of Detroit

Average Local Income Taxes as a Percent of Total Income; Source: Tax Foundation must fill out a city income tax form Local Income Tax Rates by Jurisdiction, 2011;

Michigan corporate income tax extension” Keyword Found

2011 Individual Income Tax Conversion Chart

… Roughly half of the owners of Detroit’s 305,000 properties failed to pay their 2011 tax city levies an income tax of form a semicircle around Detroit.

2011 Michigan Individual Income Tax Return Instructions

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

Treasurer’s Office Jackson MI Official Website

Hamtramck Michigan Wikipedia

2011; 2012; State of the City Government > City Services > Assessing > Property Taxes. Property Taxes even if you are not required to file income tax forms.

Treasurer’s Office Jackson MI Official Website

Detroit 1040 non resident tax form keyword-suggest-tool.com

Detroit 1040 non resident tax form keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition

General Retirement System City of Detroit (GRSD) > Retired

Income Tax Manual Return Form PDF Download

Detroit Income Tax Guide 2011 « CBS Detroit

Michigan corporate income tax extension form. 2011. The CIT imposes a 6% corporate income tax on C tax returns with the City of Detroit for tax year 2015

Detroit Income Tax Guide 2011 « CBS Detroit

Treasurer’s Office Jackson MI Official Website

2011 Michigan Individual Income Tax Return Instructions

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

Tax Forms EHTC

Treasurer’s Office Jackson MI Official Website

Do tax incentives for billionaires really work for Detroit?

2011 minnesota individual income tax return 2017 city of detroit corporate income tax return, 2017 city income tax forms and instructions to be used in filing

Detroit Income Tax Guide 2011 « CBS Detroit

Hamtramck Michigan Wikipedia

Detroit 1040 non resident tax form keyword-suggest-tool.com

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

Income Tax Manual Return Form PDF Download

2011 Individual Income Tax Conversion Chart

Hamtramck Michigan Wikipedia

View, download and print D-1065 – City Of Detroit Income Tax Partnership Return – 2011 pdf template or form online. 1672 Michigan Tax Forms And Templates are collected for any of your needs.

Hamtramck Michigan Wikipedia

General Retirement System City of Detroit (GRSD) > Retired

Do tax incentives for billionaires really work for Detroit?

2012-02-07 · California Resident Income Tax Return 2011. Form. 540 C1 Side 1. Status. City Of Detroit Income Tax 2011 D-1120 Corporation Return Instructions Page 1.

Detroit 1040 non resident tax form keyword-suggest-tool.com

Click here to access the Employer Withholding Tool for current year income tax of Tax for Part Year Residents–2011 city/income_tax_forms.php

Substitute Form W-4P Retirement System City of Detroit

Detroit 1040 non resident tax form keyword-suggest-tool.com

A bill that would require suburban employers to withhold Detroit city income taxes from Detroit income tax collection In 2011, 38 percent of Detroit

2011 Individual Income Tax Conversion Chart

Substitute Form W-4P Retirement System City of Detroit

Treasurer’s Office Jackson MI Official Website

11. Credit for tax paid to other cities (attach copy of other city returns) 12. Total Tax (line 10 less line 11) 13. Tax withheld 14. 2011 estimated payments, credits and other payments (see instructions) 15. Detroit tax paid for you by a partnership (from page 2, part 3) 16. …

Detroit Income Tax Guide 2011 « CBS Detroit

2011 Michigan Individual Income Tax Return Instructions

New York City forms; Other states’ tax forms; Income tax Nonresident Real Property Estimated Income Tax Payment Form Department of Taxation and Finance.

Tax Forms EHTC

Michigan corporate income tax extension” Keyword Found

Detroit Income Tax Guide 2011 « CBS Detroit

As of 2011 almost one in five Hamtramck The “Building Islam in Detroit: Foundations/Forms/Futures” project The city levies a city income tax of 1 percent

Income Tax Manual Return Form PDF Download

2011-10-20 · Does the city income tax put Detroit businesses at a disadvantage?

2011 Individual Income Tax Conversion Chart

Detroit Income Tax YouTube

Treasurer’s Office Jackson MI Official Website

2012-02-07 · Income Tax Forms 2010 Treasury Will Send You Personalized Forms For 2011, Unless You Used A Tax City Of Detroit Finance Department Income Tax

Dearborn Tax Help Available for Low Income Residents

Hamtramck Michigan Wikipedia

Income Tax Manual Return Form PDF Download

Learn about the Treasurer’s Office and access various income tax forms and packets.

General Retirement System City of Detroit (GRSD) > Retired

Treasurer’s Office Jackson MI Official Website

Detroit 1040 non resident tax form keyword-suggest-tool.com

Federal and State e-filing and other Michigan City income tax forms: GO TO: State of 2011 City of Lapeer Individual Tax Return (L1040). Download File.

Detroit Income Tax YouTube

Detroit Income Tax Guide 2011 « CBS Detroit

2013-04-24 · Help Detroit.” is a tax amnesty program for Anyone who has not filed income tax returns or has an outstanding balance from tax years 2011 and prior

General Retirement System City of Detroit (GRSD) > Retired

2011 Individual Income Tax Conversion Chart